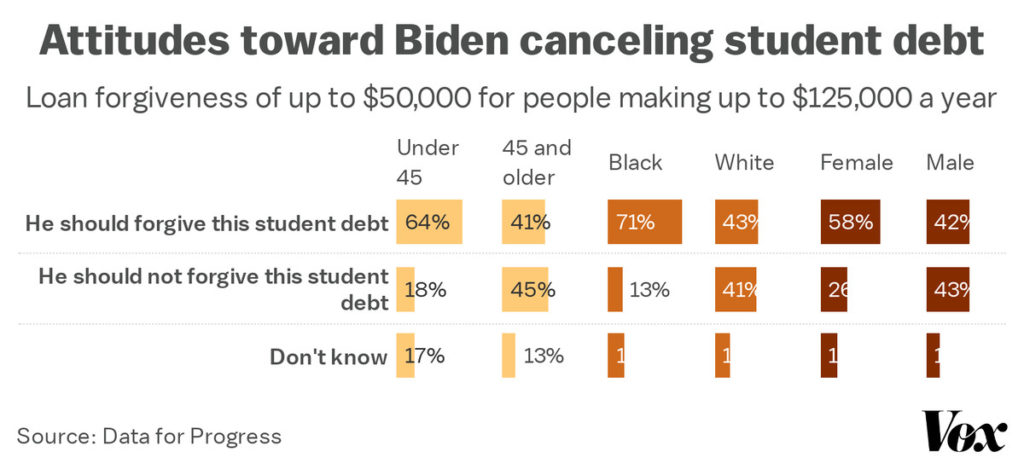

There was not much to fear with a Republican presidency forgiving debt, let alone student debt. This may all change with a Democratic Joe Biden presidency saying he would forgive $10,000 in student debt for all borrowers and the rest of the debt for public college attendees, historically Black colleges and $50,000 for those earning up to $125,000 a year. This would reduce the £1.7 trillion student loan bill by a third, according to higher-education analyst Mark Kantrowitz. This has raised questions about whether a Presidential Executive Order is even capable of such a move without going through approval by both houses of Congress. If America goes down this route, where does it stop? Credit card debt is the second-highest default rate, cancelling this would undoubtedly be more redistributive. But, as always, the true costs are hidden and often take time to reveal themselves.

Many of the politicians advocating student debt removal were simply candidates in the Presidential race, eager to curry favour in bribing their electorates. But here we have our new President who may be able to pass such a bill since the Constitution gave Congress the authority to control government property, which includes debts owed to it. Congress granted the Secretary of Education, who works for the President, “specific and unrestricted authority to create, cancel or modify debt owed under federal student loan programs.”

If Biden does choose that route on taking office, it may be met with lawsuits from Republicans or backlash from those who are punished for their previous financial responsibility. This includes those who took out loans and paid them off, those who didn’t take out loans and those who chose not to attend college. It may also block bipartisan collaboration within Congress as the Republicans feel betrayed by their new government. Beside these points, Noah Smith, Bloomberg analyst, believes that student debt forgiveness wouldn’t stimulate the economy because college graduates tend to be higher earners with a greater tendency to save rather than spend.

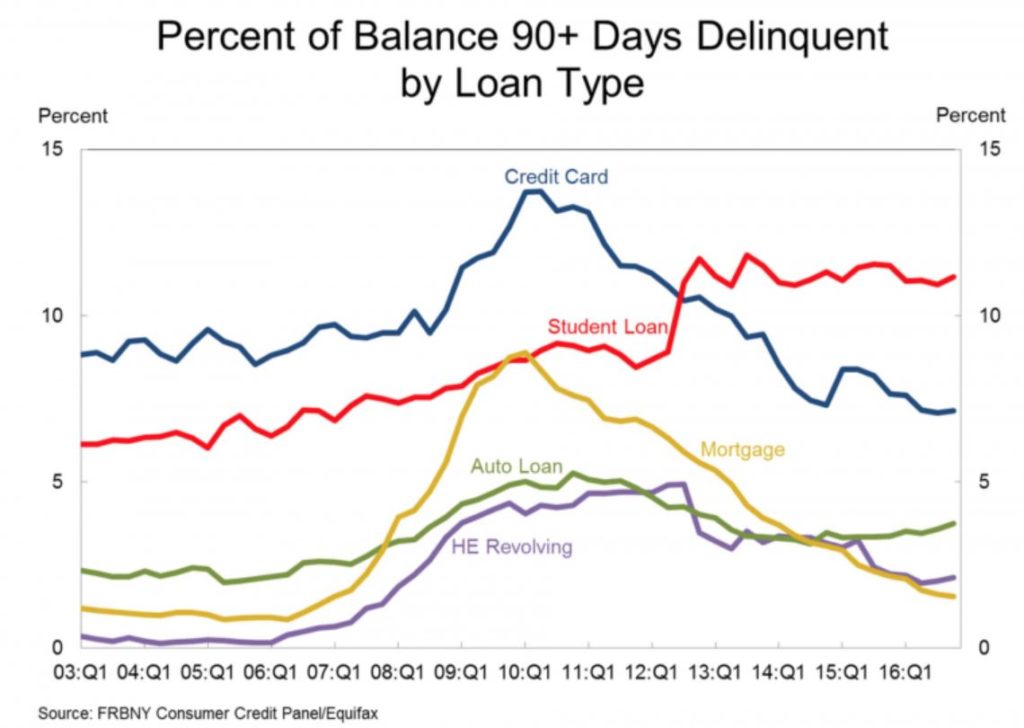

Off the back of the U.S. Department of Education offering pausing student loan payments until January to help with the Pandemic, only 11% didn’t take this up, with a Pew Research study saying 58% would find it hard to resume payments after this hiatus.

The trouble with attempting to stimulate growth via this method is debt. The debt will still have to eventually be paid by taxpayers in some other sector of the economy. You can’t just print more money and make the problem disappear. The government already issued the debt to pay for these loans. Erasing them erodes a revenue stream for the government. This weakens the belief the world has in the US government and Federal Reserve to repay and make good on its debts. Because America has a strong history backed by a dynamic, open economy with lots of new growth and products it is able to protect this image. For now.

At some point the debt burden becomes to much and there will be a reckoning. Then problems like Student Loan forgiveness will seem like child’s play.

The repayment of student loans plus interest is counted as a future asset earmarked for future expenditures when it is repaid. Forgiving the debt would require either cutting those items from the budget or finding a replacement funding source. Hence, more taxes.

One of the primary mechanisms for making student loans financially sustainable is the loan payments and interest paid today funds the loans of tomorrow. If most people paid, then the $1.7 trillion would be recycled to fund its own overhead. Forgiving a large chunk of today’s debt leaves what for tomorrow’s fund? Eventually, you run out of other people’s money. The funding must come from somewhere with the most likely outcome being either reduced future student lending or raising taxes.

For all the talk of redistribution, people go to university to access better jobs and improved life outcomes. College graduates have lower unemployment rates and higher earnings than non-graduates and trade workers. Those who never got that chance or decided to take that route are the ones who are set to be paying the bill for those who did. Only one in three American adults over age 25 actually have a bachelor’s degree. Yet college graduates typically make 85 percent more than those with only a high school diploma and earn roughly $1 million more over a lifetime. The University of Chicago and Penn Wharton School of Business have published a report stating, in fact, the richest 20% get 6x the benefit from student debt cancellation than the bottom 20%.

It is morally bankrupt to make the future descendants of fiscally responsible or truly poor non-collegiate Americans foot the bill for the 44 million Americans with some form of student debt. All of these people voluntarily signed onto the debt. All those voters acting in their immediate self-interest to vote for the politicians making ridiculous promises is effectively stealing from others.

People who go to universities ill-informed to schools they can’t afford, choosing unmarketable majors, borrowing too much money, when there are other more suitable jobs like becoming a mechanic, perhaps partying and freeriding instead of focusing on studying – want to blame someone else. The government is a convenient scapegoat.

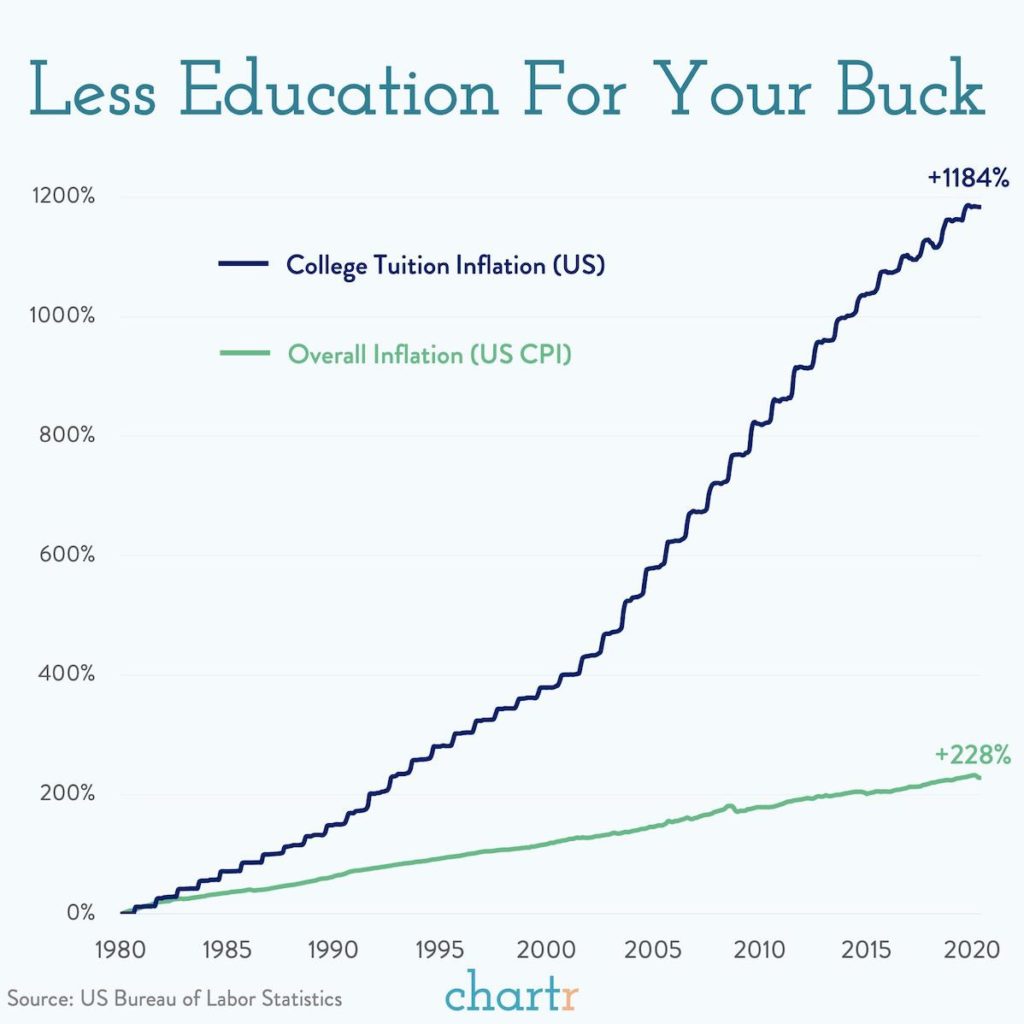

Having said that, no school is affordable. Tuition costs have outpaced real earnings exponentially beyond any other comparable individual cost.

The problem is one of the government intervening in the funding scheme providing limitless, guaranteed loans for the universities to receive. The only way to get the cost of education down is to decrease the university’s need to have skin in the game. The government is loaning huge sums to students that never complete their education and cannot afford to pay the funds back. It is a debt transfer from students with degrees to hard-working, thrifty citizens – the ultimate insult to the US Constitution.

This will continue so long as politicians keep throwing more money at problems. Without delving into progressive politicians appearing to reduce inequality, while simultaneously known or unknown to them, ensuring disenfranchisement so they can later bribe voters is a distortion to a system that was not designed to survive such an ignorant electorate.

Big changes do not happen overnight. This works both ways, hopefully, what made student loans untenable will also prevent their overnight Presidential forgiveness. The US government was designed to prevent knee jerks and mob mentality legislation. And we should all be thankful for that.