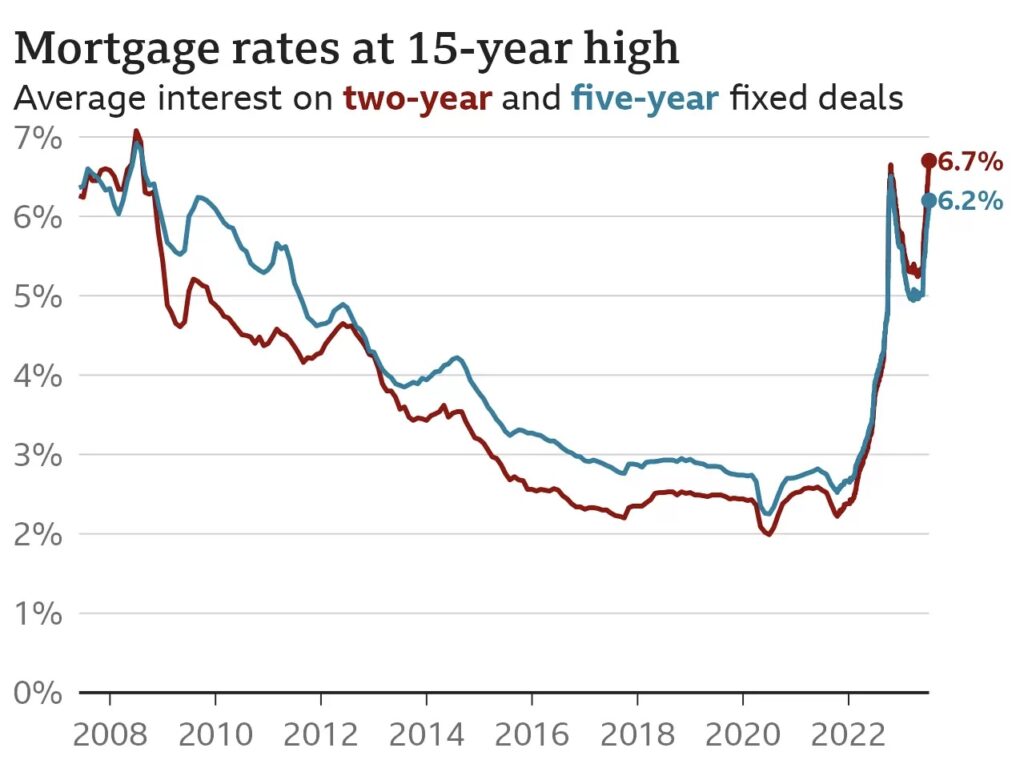

Mortgage payments reach the highest level since the 2008 financial crisis for those on a two-year fixed deal

Millions of households are under great financial pressure as the Bank of England increases interest rates in efforts to lower high inflation.

Mortgage repayments have been affected as rates on two-year fixed deals rise to levels not seen since the financial crash.

The Bank of England (BOE) recently released a financial stability report stating “In the UK, more households are being affected by higher interest rates as fixed-rate mortgage deals expire. The proportion of households with high debt service ratios, after accounting for the higher cost of living, has increased and is expected to continue to do so through 2023. But it is projected to remain some way below the historic peak reached in 2007”

The BOE projects rates to remain below rates reached in 2007 hoping to lower speculation around mortgage rates.

The report also states millions of homeowners on new mortgage contracts in the forthcoming years will pay approximately £220 extra per month, which some label a drastic increase that is unaffordable.

“Which comes first the economy or the individual?”

Financial journalist Martin Lewis on Good Morning Britain argues mortgage repayments are bound to rise as increased interest rates are “one of the core ways to fight inflation”.

He states this is a “huge bill shock” to millions of homeowners affected as questioning what the government must prioritise, “the economy or the individual”.

Although many speculate that mortgage rates will come down, Lewis suggests there is no guarantee rates will drop back to normal. People may only say so “only and if” rates did come down.

For future homeowners, concerns grow as they question if they can afford mortgages where renting seems to be a better option.