Cryptocurrencies are a social phenomenon that presents a new frontier in global finance. With a vast range of offerings and a widening range of functions, many consumers are trying to learn more about the new asset class, willing to invest more of their time and money than ever before. This increased interest from the public has led to broader investment in the sector.

How Crypto Has Evolved

With over 300 million cryptocurrency users worldwide, India, Nigeria, the United States, Vietnam, and the United Kingdom lead the pack. The average crypto ownership rate by country is 3.9%, while more than 18,000 businesses now accept forms of cryptocurrency as payment.

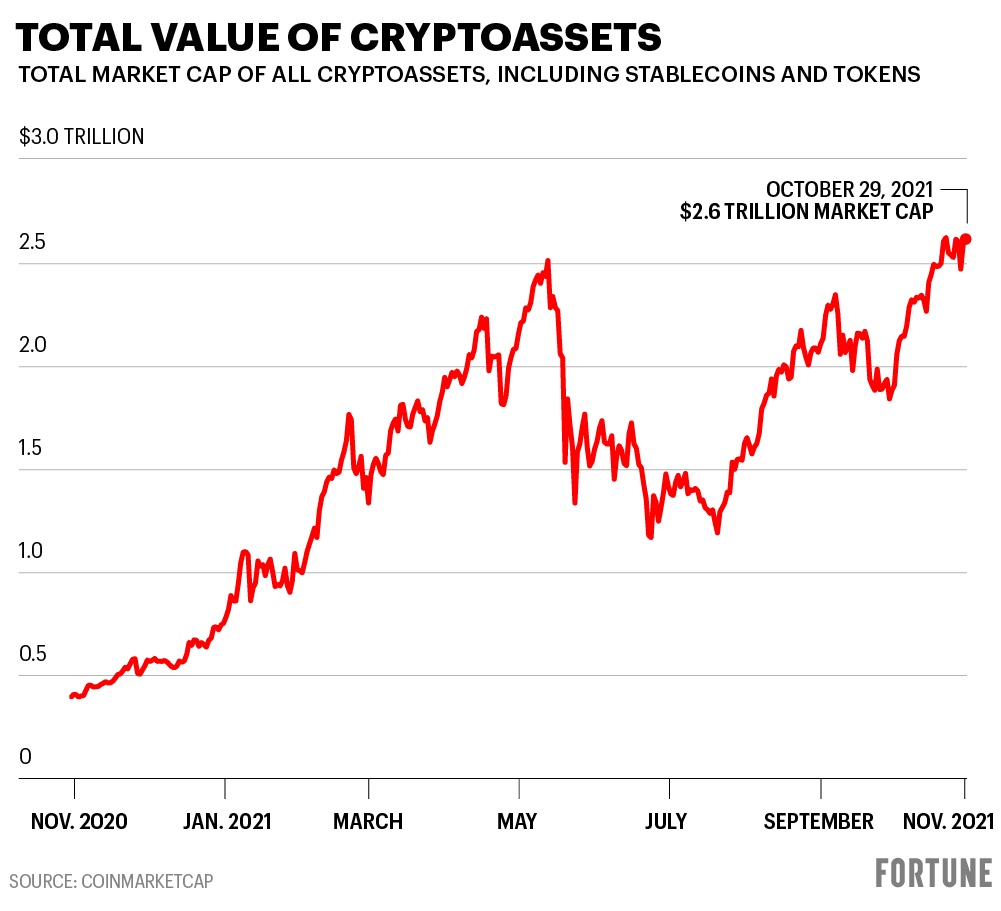

The most highly valued cryptocurrency, Bitcoin, went from a $60 billion market capitalization in 2018 to an $825 billion capitalization today. Global hash rates, the computing power used to verify transactions and mine new coins, reached all-time highs in 2021.

This comprehensive public adoption and expansion led to more significant investment. In turn, this investment has protected innovation, enabling the sector to evolve and expand rapidly.

The technology and size of the network have set a foundation for a truly global financial system.

And while significant obstacles, including government regulation and internet access, remain, those bullish on the asset class argue these risks will help define the space moving forward.

Is The Hype Over Cryptocurrency Too Early?

Cryptocurrencies offer new solutions to complex problems. Some insist it can be the later global form of payment and wealth building. However, with just 300 million users, it is still far from a truly global financial system.

The asset also presents a tremendous financial risk, with constant volatility and little institutional recourse in the case of theft or loss.

Whether a cryptocurrency will replace fiat currencies like the U.S. Dollar or the British Pound in the next five years remains to be seen. It is more likely to complement our traditional financial systems than overtake them completely.