Most people either understand Bitcoin and have invested in it, or have no clue how it works. Bitcoin has eluded most of us as we just watch the figures rise and fall and imagine a time when we could have bought 1 whole bitcoin for a couple of GBP. How does Bitcoin actually work, and is it a Ponzi scheme?

What is Bitcoin: “Each Bitcoin is basically a computer file which is stored in a ‘digital wallet’ app on a smartphone or computer. People can send Bitcoins (or part of one) to your digital wallet, and you can send Bitcoins to other people. Every single transaction is recorded in a public list called the blockchain.”

The price of bitcoin fell by $600 in just 30 minutes to take its value below $10,000. The flash crash resulted in around $10 billion being wiped from the cryptocurrency’s overall value and has called into question recent positive price predictions as BTC USD fell from a Summer high of $14,000 to $7,750 in only 2 months.

Bitcoin may not become a globally adopted currency for everyday transactions.

The “true” value of Bitcoin depends on its future use case. If users would, en masse, lose interest, then it could end at zero. On the other hand, in the unlikely scenario that Bitcoin takes over all worldwide payments, its value could rise beyond $1mln.

Yet as Bitcoin is failing as a payment system, and is now primarily used as an asset to hold, the only remaining justification for investing in Bitcoin is the assumption that others are willing to buy Bitcoin at higher prices in the future.

If BTC hits $15,000 by end of year, it would be rejoiced by its advocates.

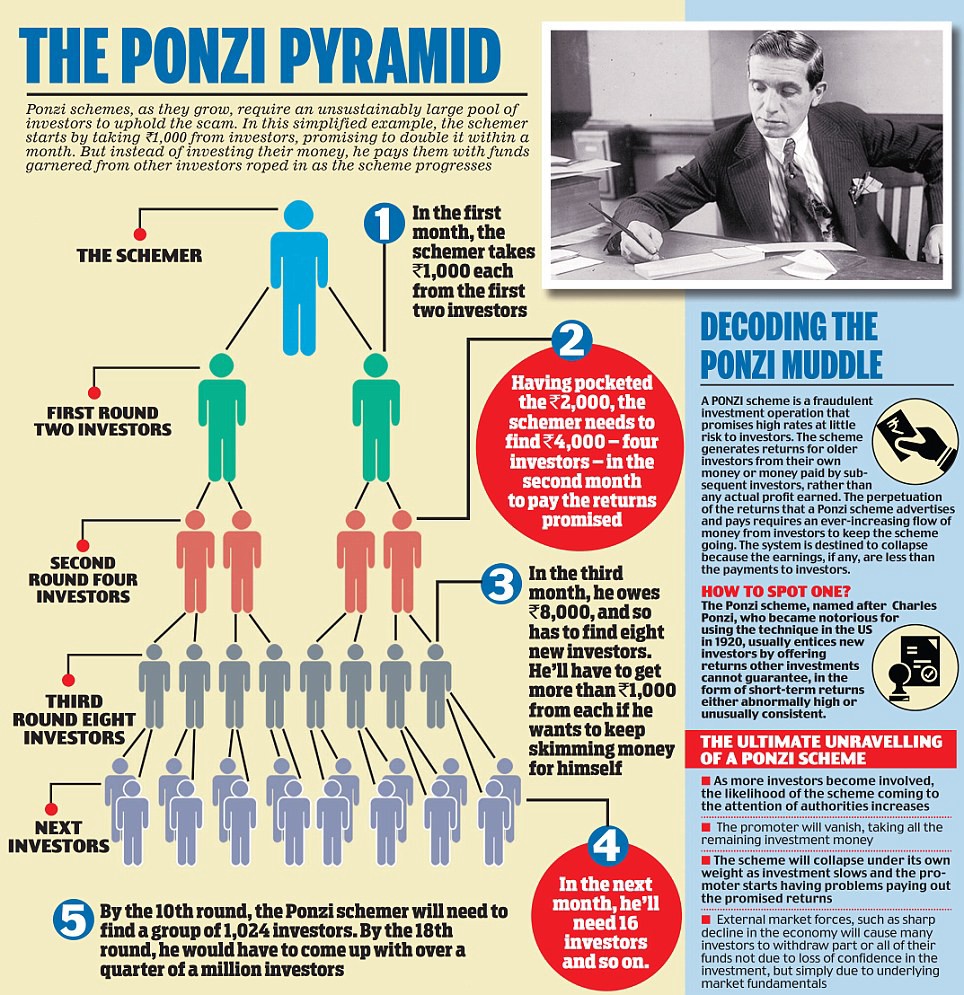

$20,000 would be naysayers rethinking their belief systems as they dismissed it “the ultimate Ponzi scheme” since Charles Ponzi.

By definition alone, Ponzi schemes must fulfil the following criteria:

- Secrecy – Bitcoin is open source. Anyone can see it at any time.

- Complex – many millions worldwide are capable engaging with cryptography behind the Blockchain that Bitcoin is built upon.

- Unregistered Investments – In the developed countries, Bitcoin is now classed as a registered asset and gains are taxable under capital gains.

- Low risk, high investment returns – in the short term, Bitcoin has had negative or flat growth. Over many years, it may generate returns.

- Overly consistent returns – Bitcoin returns are only consistent over 4 year windows.

- Unlicensed sellers – most exchanges are registered and compliant with that country’s regulations. Those exchanges that don’t have adequate security have been hacked and others have lost investor confidence. This has streamlined the number of exchanges.

- Paperwork issues – Bitcoin code, though complex, can be monitored and reviewed by anyone, anywhere. Crypto exchanges are now micromanaged by relevant taxation departments.

- Difficulty withdrawing or receiving payments – Bitcoin has overcome its liquidity issues and high fees. It can be converted at any time to fiat through any registered exchange worldwide. ATMs are available for withdrawal of fiat currency from Bitcoin holdings. Exchanges don’t lock in your funds until the next bull run before selling.

- Unbacked – Bitcoin has the backing of the cryptography that requires vast computing processing power and large electricity supplies that could have otherwise been directed elsewhere. It differs from the US dollar as fiat, which is underpinned by the gross domestic product of the country, its resources, assets and taxation revenues and capabilities. Both approaches differ from physical goods such as gold or silver, commodity money.

Professional Bitcoin speculators are forecasting $15,000 – $20,000 level for the next 18 months for this new asset class.