When it comes to investing in commodities like the energy sector in today’s environment, one thing that a lot of people don’t appreciate enough is the importance of understanding what you’re betting on.

When someone thinks the price of oil will rise, to take advantage of this, they start buying British Petroleum shares. Satisfied with their timely acquisition, and chuffed to pieces with how clever they have been to outsmart the market should oil commodity prices rise in future, they’ve actually gambled their capital without understanding the potential implications of such a position.

What if I told you that the West Texas Intermediate and/or Brent Crude aren’t interchangeable bets with petroleum companies?

The trouble with broadly asking questions like “Is now a good time to buy oil stocks?”, is investors aren’t really asking about the stocks in question, but really whether the price of oil is going up.

In this sense, you’re not actually investing in the companies – you’re simply betting on the commodity. Don’t get me wrong, this is a perfectly fine thing to do if you believe you have a differentiated perspective on the macroeconomic factors driving supply and demand in the oil market. But if you really have such conviction in this perspective, there would seem to be a much simpler and cleaner way of expressing this view – namely, buying oil futures.

If you’d like to invest in an energy company, your thesis cannot be centred around the assumption that the price of oil is going up. You need to be able to argue why there is value to be had in your stock even in a “lower for longer” commodity environment, or why it is a relative bargain compared to its peers at today’s prices.

Its main operations may not even be in crude oil. It might well have diversified into renewable technologies or liquid petroleum gases. This would already dampen the correlation between the commodity price and your stock price based off the original assertion.

Furthermore, in terms of its competitors, what quality reserves does it mine, pump or dig? Does it have new drilling rights, access to advancements in refining capabilities or is it operating with direct authorisation on good terms with the national and local governments that give it exclusive rights to that oil field or gas farm?

Will that be enough to ensure a wide economic moat against its competitors?

Namely, the proposition: “commodity price rising” as the justification for investing in a given stock dealing with that commodity is too makeshift an indicator by itself. Don’t then ask, “Is it a good time to buy oil stocks?” when you really want to know “Is it a good time to buy oil?”. Those questions are quite different but the distinction is easily overlooked.

The Iron Ore Conundrum

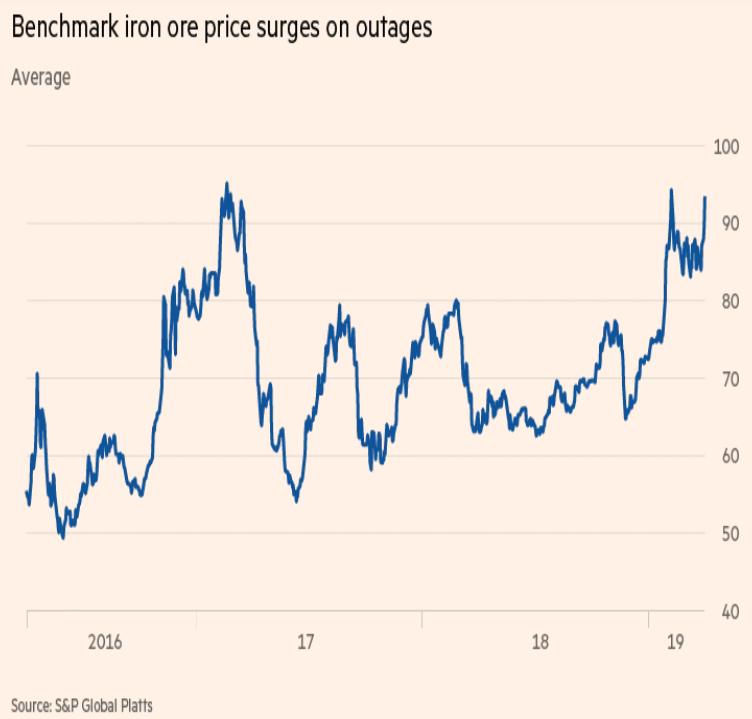

One such example of this disjuncture in logic would be the significantly higher quality of Brazilian Vale S.A’s highly-sought after, high-grade iron ore that Chinese steel mills prefer to maximise steel production from their blast furnaces, as less coke must be used. Before the court order against Vale to stop production at eight tailings dams and the 9 per cent predicted drop in annual output, it produced considerably more high-grade iron ore than Rio Tinto and BHP Group (58 and 62 per cent). If I had thought the price of iron ore would increase because of demand for high-quality steel, and bought into Vale S.A. with the expectation that the value of my investment would rise alongside steel prices, I would be rather disappointed. Iron ore did rise from $65 to $95 (46 per cent) meanwhile Vale SA lost 27 per cent as the share price fell from 15$ to 11$.

Similarly, if you thought after the Vale SA’s dam collapse that iron ore prices would rise globally, then it would have been more prudent to invest in iron futures rather than Vale SA’s competitors Rio Tinto and BHP Group.

There isn’t some universal law that Vale’s misfortunes are a competitors’ gains. Rio Tinto ended up declaring force majeure after the recent cyclone in Australia and BHP reducing guidance, pointing to little spare capacity for high-quality benchmark ore in the market to meet Chinese demand. Environmental curbs in China have hit domestic production of low-quality iron ore, e.g. Heibei province is closing 40 mines in 2019 alone.

In this instance, Chinese steel mills were left with limited, albeit undesirable, options. They could have substituted in lower grade iron ore from Australia’s Rio Tinto or BHP, but this would require more coke input for the conversion to pig iron, generating less efficient and unacceptably higher polluting processing and lower output.

Alternatively, they could have hoped for rising steel prices to offset continuation of more expensive high-quality iron ore, and simultaneously lower production in the meantime to steady costs.

As with all investing, it’s a multifaceted arena of trade offs and unknown variables that aren’t easily controlled for or anticipated.

As always, if you’re trying to actively beat market returns, do your own research. If you think a commodity price is set to rise, ask why a given stock is a better choice than simply the commodity futures market. After all, stocks and commodities are not necessarily the same thing.