Mark Cuban says that as long as money flows into passive funds, they will continue to rise. This seems like a truism. Meanwhile Paul Tudor Jones and Dr Michael J Burry are very concerned by the distortions and illiquidity having every last nickle and dime of capital flow into passive tracker funds holding very few stocks versus the wider market, depriving many others of desperately needed capital. Who’s right, and will this cause the next global recession?

How Prepared Are Millennials For the Next Recession?

Most people are never prepared. When things are going well in the economy, the last thing we want to do is prepare for the worst. But the most enduring maxim is to leave the party early when you are having a good time. When the drinks are flowing, the toasting and back slapping become a perverse echo chamber of positive feedback. Those rushes of endorphins and serotonin make it hard to step back and see the bigger picture.

The downturn is happening, slowly but surely for several years now. This time round, the depression will be much quicker as the panic and confusion are propagated much quicker via immediate global coverage and mobile devices. That aside, little really changes.

Survival – Avoid the obvious traps

Finding the centre of gravity where an over-sized portion of the capital is invested into something that will not give nearly enough return to satisfy is a good place to start.

What will collapse the system?

Millennials’ largest concern should be their passive investments they have been pushed toward for several years now. Everyone from Nutmeg, to fintech start-ups like Monese, Revolut, Starling etc. all offer investment propositions now for “invest your spare change” or your savings directly into low-cost, passive Exchange Traded Funds (ETFs ) such as Vanguard to S&P 500 trackers.

ETFs are stocks that trade reflecting a bundle of assets like stocks within them. They often operate with arbitrage mechanisms to buy and sell their units to keep them trading near their underlying value. But what happens when the value becomes distorted because it fails to reflect the underlying investments or leverage (borrowing) to artificially create more exposure to the ups and downs, lack of buyers of the ETF units or difficulty to liquidate positions?

Rise and Fall of Star Manager Neil Woodford, United Kingdom

Take “Star-studded” fund manager Neil Woodford, who has caused hundreds of thousands of his investors in his flagship fund, Woodford Equity Income, to face large losses. The fund remained closed from last year because the fund portfolio was highly illiquid and selling those unquoted assets in a timely fashion is highly problematic. The first pay-outs from the frozen fund have now begun, with many investors losing more than half their money.

The 4.7 trillion in Exchange Traded Funds and the illiquidity are assets that cannot easily be sold or exchanged for cash without a substantial loss in value. Illiquid assets may also be hard to sell quickly because of a lack of ready and willing investors or speculators to purchase the asset.

This makes it difficult to rebalance the underlying shares, making it impossible to track the performance of the index.

Dr Michael J Burry and the Credit Default Swap

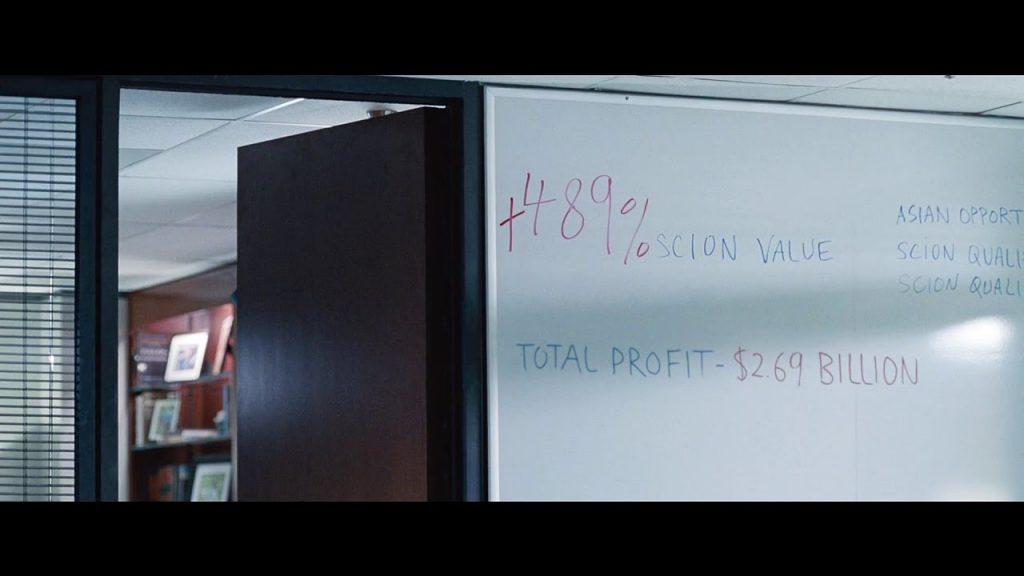

Dr Michael J Burry, who’s story was immortalised in box office hit The Big Short in 2016, bet against the Collateralized Debt Obligations (CDO) mezzanine tranches in 2007-08 to make $2.6 billion for his Scion Capital Hedge Fund. CDO’s are structured financial product that pool together cash flow-generating assets and repackages this asset pool into discrete tranches that can be sold to investors with varying risk profiles – or so we all thought…

Dr Burry notes the 52.5% illiquidity of the Russell 2000 index in 2020 and the similarities passive investing has with CDO markets of 2007.

Finding the centre of gravity where an over-sized portion of the capital is invested into something that will not give nearly enough return to satisfy is a good place to start.

Passive investing a bubble cash-strapping small cap companies

It becomes ugly when people sell their ETFs. The ETFs get retired, meaning the underlying stock must be sold. They can only be sold if there is a buyer. The ETFs have buyers on a daily basis, but when there aren’t buyers, the issuing bank or fund is the buyer of last resort. A run on an illiquid fund that cannot sell its underlying assets or is too highly leveraged that they cannot then meet those withdrawal requests, the institution will become insolvent. With more people withdrawing money, they will use up their cash reserves and ultimately end up defaulting.

These indexes are based on market capitalisation (price of stock / shares outstanding), meaning large-cap (market cap) stocks will have a greater weight (presence) in the index, relative to those with smaller market caps. Noteworthy is 1049 of the constituent stocks in the Russell 2000 are very illiquid with under $5 million in volume (traded back and forth) each day. The sponsors of ETFs have purchased futures (bets on future prices) to replicate the index, instead of the actual stocks themselves. This can provide leverage (extra exposure to the underlying prices through borrowing or artificial creation of ETF shares as part of the mechanism). This is what happened with the CDO market in the 2000’s, when the limited supply of new mortgages to bundle up into tranches dried up – they looked elsewhere to create more money out of thin air via synthetic investments not backed by any tangible assets.

Synthetic CDOs 2000s: the ETFs of the 2020s?

CDOs became derivatives or synthetic CDOs when they ceased to be a direct ownership in anything, but rather a contract whose value is derived from another security (CDO that is backed up by a mortgage bundle or tranche). Synthetics are contracts referencing the performance of financial assets.

Credit Default Swaps – Profiting from the downside

Just as the synthetic CDOs in 2007 offered greater profits, the institutions creating them were using credit default swaps (CDS) to short sell the grouped mortgage packages.

The CDSs transferred the risk to the insurer so long as the purchaser of the swaps paid the premiums. In the event the issuer faces a credit event, like AIG did in 2008 with its collapse, those holding the CDSs like Dr Burry and even hedge funds and investment banks, they could profit off the defaulting in the housing market.

ETFs offer the same today through leverage, creation of stock based upon unknown correspondence to contracts referencing the performance of financial assets held within the ETF. This could multiply losses by providing more supply that cannot possibly clear in a downturn.

When expressed in such loosely referential terms, it becomes easier to see how out of whack the ETF market could potentially be. The lack of transparency should be a major cause for concern. What if new ETF stock is being issued based on such illiquid assets while simultaneously distorting asset prices of the small cap stocks, depriving them of funding while artificially inflating the main holdings in the funds. When the house of cards comes crashing down, do we know whether there is a short selling position against the ETFs to protect profits of the large institutions?

Firms creating ETFs could be betting against the clients who purchased into them, setting their clients up to lose billions of dollars if the stock market implodes. Simultaneous selling to customers and shorting them because they believe the market will take a downturn and the ETFs will default is the most cynical use of credit information since the Housing Crisis 2007-08.

When you buy protection against an event that you have a hand in causing, you are buying fire insurance on someone else’s house and then committing arson.

Asset Class Bubbles

Large market distortions as money flows into certain stocks at the expense of valuations and ratios in various other asset classes or even in other overlooked stocks themselves becomes problematic for efficient market hypothesis. Bubbles appear, such as tech stocks that feature prominently in ETF holdings due to their market capitalisation and their stellar share price growth for the past decade. And with bubbles come the inevitable corrections. Sometimes they need a poke to pop, other times confidence can simply evaporate as selling gives way to yet more selling.

Another Perspective

This flight to index funds on the passive side of the market has been commented on by Mark Cuban, who sold Broadcast.com to Yahoo in April 1999 for $5.7 billion during the tech bubble. He believes as “as long as those funds keep on growing the market is going to go up”. Trouble is, most of us aren’t eyeball deep in economic data but busy leading our daily lives.

Any variation of factors could tip the balance and be the straw that proverbially breaks the camel’s back. Whether impeachment, coronavirus pandemic, increases in the cost of borrowing should the Federal Reserve try to rein in inflation, a Swedish property collapse, etc. Trying to pinpoint one or another with any degree of certainty is futile. Trust the economists (or not, as you please.) They spotted at least nine of the last three recessions. Buy gold last year – it’s too late now !