Recession indicators firing off left right and centre, with Trump escalating the tariffs against Xi in a personal grudge match with little regard for the billions they directly impact. The last time this happened in 1929, it wasn’t until 1954 before the economy recovered. Are we poised for another Great Depression?

The single largest threat to the economy is debt. In 2007, it wasn’t even comparable. This time, it will cripple the monetary and fiscal stimulus to push recovery. After debt, going forwards, any decision to devalue the dollar in an attempt to salvage corporate profits is tantamount to economic suicide.

The US Dollar lost 45% of its value between 2002 and 2008. Fuel prices quadrupled at the pump.

It will happen again, and no, US production of crude to sell abroad won’t alter that dynamic.

US crude is sold on global markets because it garners $10/bbl more than if sold domestically. And that won’t change. The US consumer can’t just reallocate that fuel to domestic consumption to address the devalued dollar.

So, prepare for $15/gal gasoline in the next few years if we don’t turn this ship around.

Trade War and Tariffs

With trade war escalations once more, Trump’s advisers must be whispering in his ear he is gambling the US economy on “breaking China”. He does not seem to care how high gasoline companies will go as a result.

He will not break China, anymore than China could break the US if the shoe were on the other foot.

A recession is becoming inevitable, the only question being: “has it already started and we just don’t see it, and if not, when will it start?”

I would suggest that the economy has been stagnating for the past 19 months in the United States, and is in a gradual slowdown. The die has already been cast.

Trump could reverse the decline simply by pulling all tariffs. But he won’t. The trade war has become “personal” now, him against Xi.

And it will play out as expected, dragging the US economy into the gutter. And with that $22 trillion debt, and Fed Funds rate as low as it is, the Fed will not have any ammo to bring to the rescue.

Last Time Around

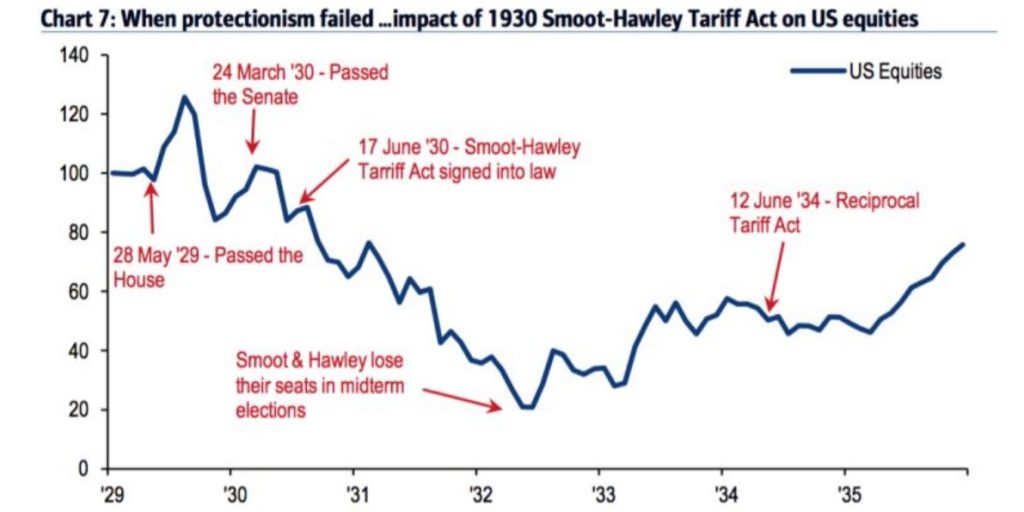

The last time “something like this” happened, in 1929, and surprise, surprise a tariffs act was again front and centre – Smooth-Hawley Tariff Act of 1930 – the recovery took 25 years.

The stock market didn’t bottom after the 1929 crash until 1932. A 90% fall, and then a further crash of 50% in 1937. This is potentially what we are looking at.

It wasn’t until 1954 after the Second World War’s devastation and the Marshall Plan (European Recovery Programme, ERP) – an American initiative passed in 1948 to aid and rebuild Europe with $12 billion ($100 billion in 2018 US Dollars) economic assistance – that the world economy could finally heave a deep sigh of relief.

America then entered the most prosperous phase the world has ever seen. Out of the ashes rose a phoenix. Hopefully, this time around, it won’t take so long.

Look to the Farms Dorothy

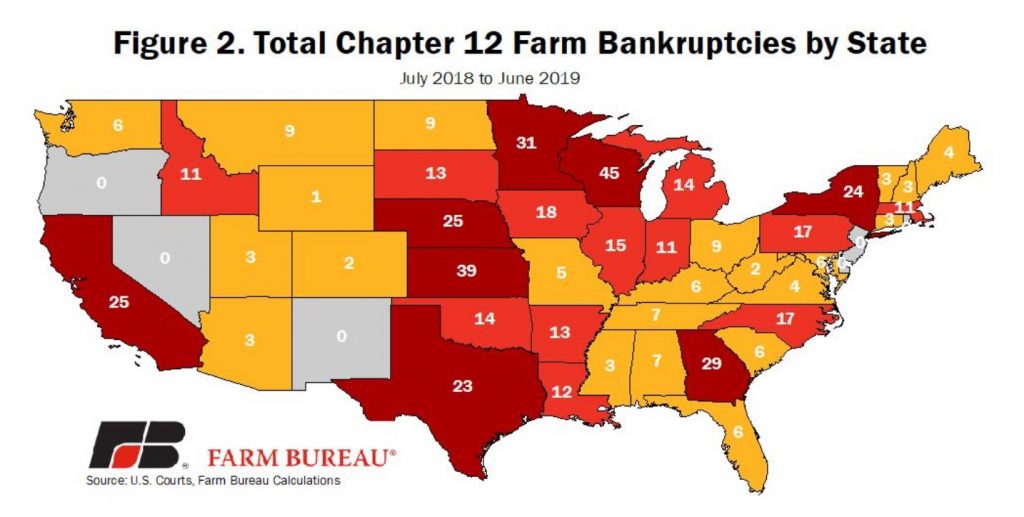

International trade will fall and retaliatory tariffs and measures by China will stifle growth further. American farmers are already feeling the hit, with farm bankruptcy filings up 13%.

Following several years of low farm income and rising debt levels, a review of Federal Deposit Insurance Corporation quarterly call report data reveals that the delinquency rates for commercial agricultural loans in both the real estate and non-real estate lending sectors are at a six-year high.

The biggest increase in bankruptcies, 50%, occurred in the Northwest, which includes Washington, Oregon, Idaho, Montana and Wyoming.

Across the U.S., farm loan delinquencies and Chapter 12 bankruptcies are rising. The deteriorating financial conditions for farmers and ranchers are a direct result of several years of low farm income, a low return on farm assets, mounting debt, more natural disasters and the second year of retaliatory tariffs on many U.S. agricultural products.

The administration and Congress have done a good deal to assist farmers and ranchers, including passing the 2018 farm bill, as well as a disaster aid package, and providing a second round of Market Facilitation Program trade assistance payments, e.g., What to Expect in the New Disaster Aid Package, USDA Announces Details Behind the New Trade Aid Package and Estimating Dairy Trade Aid Payments.

In addition to these financial assistance packages, the House of Representatives recently passed the Family Farmer Relief Act, which updates Chapter 12 bankruptcy eligibility. Chapter 12 bankruptcies provide a seasonal repayment schedule over a three- to five-year period and lower costs relative to other chapters.

But, be under no illusions, this is a major concerted and multilateral aid response to prop up US farming. The tariffs will start to pinch tighter, with mass liquidations and consolidations in the agricultural industry are just the start.

Time to batten down the hatches, because Trump made this personal. And, for all his postulating, no amount of huffing and puffing can completely ignore the lessons of history.

…………………………………………………………………………………………………………………………

For further reading:

Identifying the why we do anything we do is crucial. More relevantly, interest in economics. Word of warning: no religion of absolutism, like any of the classical economics, both old and new, can accurately or reliably encircle the world’s relativity.

Hence, your interest and knowledge of a religion of economics incompatible with human evolution, will and must be frowned upon. Not in the least because the many outdated proxies from our past are unlikely to ever offer a great foundation for a bright new future that breaks from the norm.

1/ John Kenneth Galbraith and Nicole Salinger “Almost Everyone’s Guide to Economics” (Houghton Mifflin Company, 1978) – a paperback of 162 pages, done in conversational interview format. Very digestible and lightweight in tone but not in coverage. Covers economics from all sides in layman’s terms.

2/ But perhaps the only book you need to read is “The Great Crash, 1929” by John Galbraith.

Galbraith broaches the lead up to the Great Crash (3/5TH), its aftermath (1/5TH) and the contribution to the Great Depression (1/5th).

It finally put to bed all the false interpretations of the Crash and the beginnings of the Depression. Galbraith paints a picture clear as day about the effects of tariffs as in the passage of the Hawley Smoot Tariff Act. Tariffs, if not properly applied and rescinded when they cease to result in intended consequences lead to cascading destruction of trade.

While The Great Crash of 1929 offers sound analysis of the stock market crash, he ignores the Federal Reserve and largely omits changes in the money supply. While Friedman goes so far to say monetary factors caused the Great Depression, many contemporary economists would disagree. The money hypothesis contributed to the Depression but did not cause it. In hindsight, Galbraith’s tentative analysis of what caused the Great Depression is incomplete, but, ironically, more accurate than Friedman’s monetary analysis.

3/ Hyman Minksy or Keynes’ ‘General Theory’ better capture the theoretical underpinnings of the business cycle. But also why New Keynesianism is wrong in its belief supply-side loosenings, like lifting employment regulations, cutting taxes or liberalising immigration laws, will actually make things worse in a recession, as will interventions that increase price flexibility.