Some believe the stock market lies the key to riches. Others, the currency markets. Some just prefer sports betting or casinos. For the baby boomer generation, a rising stock market, the golden standard of pensions and housing boom in the UK has led to their demographic hitting the jackpot. For their children, many of whom are the millennial generation, they have not been so lucky.

Baby boomers bought when the property market was comparatively very affordable against annual salaries. They were able to afford deposits and pay them off over 25 to 40 years. If you have no mortgage, then there is no reason to move. Many have gone on to buy a second home to move into or a holiday home and ended up not selling their original property because they didn’t have to, becoming accidental landlords in the process.

Many retired and didn’t move out. This reduces the supply of houses for sale, causing more buyers to chase after fewer properties, and hence, prices rose. Rising prices were also influenced by waves of Middle Eastern petrodollars, Russian oligarchs, corrupt despotic dictators and regimes throughout the world, Chinese, Malaysians, Indians and London reinventing itself as a World City with a large financial hub ‘The City’.

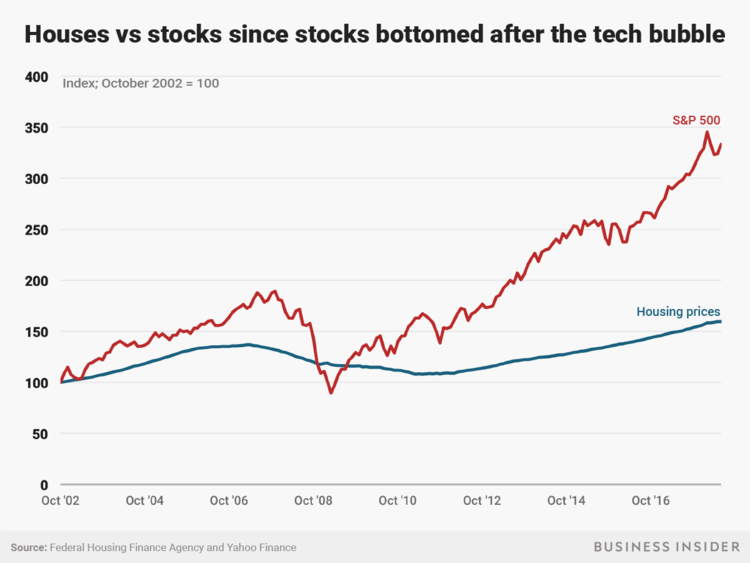

This rise in real estate in the 1980s 1990s and early 2000s has not been maintained. Deposits are harder to save for based on the rise in earnings, and rent erodes that which can be saved by potential younger homeowners. Generous pension arrangements have been scrapped. We have had the Great Recession and the Dot Com bust. So where lies the answer to financial security?

Millennials entering the inflated property market also suffered from slow to negative growth in property values. While rents continued to rise, straining capacity to save for a deposit, the stock market may have the answer for this lost generation of childless, pet owners living with their parents in their 30s.

What is achievable?

For most individuals, reality falls short of expectations.

Speaking with some friends, they believed mutual funds could earn a steady 14 per cent over the long term. They thought this would be adequate to generate some serious dough through compounding.

If you want to get rich, starting with minimal capital, you need more along the lines of double this annually. This would generally require direct investment in stocks.

Young investors seem to crave and almost demand the elusive cliché of overnight success.

Mutual funds are good enough to help attain financial goals and given enough time will make you financially independent. For shorter-term ambitions, without the necessary funds, mutual funds are unlikely to achieve those results.

Be under no illusions, you are very optimistic if you think you can earn 30 per cent from the same stock market that your mutual fund manager only achieves 14 per cent on.

Joe Raedle/Getty Images

What is the difference?

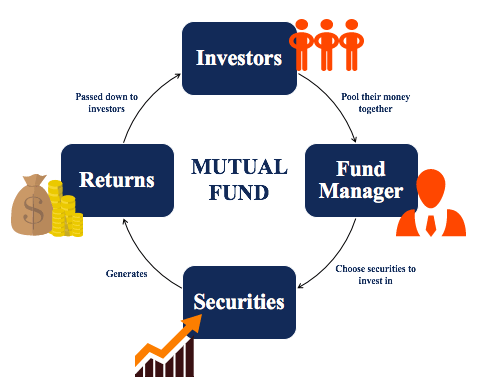

Stocks are just single companies, while mutual funds hold several investments anywhere up to hundreds of stocks being part of a single fund.

Stocks share in one company’s profits. The best way to invest via these is to build your own portfolio by selecting specific companies. Fees paid will be commissions on the trades when you buy and sell.

Mutual funds can be passive Exchange Traded Funds (ETFs) that track benchmarks, index funds or active mutual funds managed by a professional. Passive funds simply buy and sell holdings based on what is in the underlying index, like the FTSE 100 – the UK’s largest 100 companies by market cap. These are best for quick, easy diversification to gain access to many stocks through a single transaction. Fees come as annual expense ratios. These may be sales loads, short-term redemption fees and/or transaction fees. ETFs trade like stocks, with trade commissions when bought or sold.

PROS MUTUAL FUNDS

- Easy to diversify because every single fund owns small pieces of numerous investments

- Personal management of funds is available through actively managed funds

- Investors can avoid bearing the trade costs

- It is less time-intensive and more convenient for the investor

- Low ongoing fees

CONS MUTUAL FUNDS

- Yearly expense ratio

- Many funds have minimum investment sizes, e.g. £1000 or up.

- Mutual funds can trade only once each day

- Less tax-efficient than stocks

Stocks can be treated as “Bed and ISA”. This is a double transaction to shelter non-ISA investments from capital gains tax and further tax on dividends. It is done by selling or “bedding” investments which the profits are taxable. The proceeds can then buy them back immediately within the tax-efficient wrapper of the ISA. Shares cannot be moved “in-specie” (as holdings), they must be sold, and cash transferred before they can be repurchased. Profit generated in step one is still subject to capital gains tax and cash balance transferred is deducted from your annual ISA allowance (£20,000 UK adults).

PROS STOCKS

- They can be highly liquid in nature

- They do not contain any ongoing or annual fees.

- Stocks are ownership, so investors can influence management and company direction.

- Stocks can be very tax-efficient, with the investor controlling capital gains returns.

CONS STOCKS

- Stocks typically carry more risk than mutual funds.

- Have to hold many individual stocks in different sectors, phases and size to adequately diversify.

- Time-intensive, as investors must research and follow each individual stock in their portfolio.

- Being an investor, you will have to pay a commission each time you buy and sell.

- Some individual shares require stamp duty to be paid and other levies like Panel of Takeovers and Mergers (PTM).

- When selling and rebuying shares to realise a tax gain within annual allowances, there is a risk of a price movement while you’re out of the market. Therefore, a difference in sell and buy price between the open and close of the trade. This can result in buying back fewer shares than you originally held. By using the ‘bed and ISA’ process, this risk is capped at between either £30 or £50 spread per line of stock by most brokers.

As a retail investor, it is very difficult to pick multi-bagger stocks as there are various factors influencing the stock price. Macroeconomic, technical and fundamental are just three facets of this.

Investment bankers or mutual fund managers’ roles are to keep track of these factors and handpick the right stock for the fund.

Diversification in a mutual fund investing in a pool of stock reduces the risk. If ABC Ltd goes bankrupt, there would be other stocks with stellar returns to compensate and offset the loss.

Another consideration for the retail investor is irrationality. Put simply, your average retail investor will be unwilling to buy a stock bought at £100 that rises to £200 at the £200 level. Buying it would reduce their percentage gain.

Should the same stock fall to £50. The unrealised loss is -50 per cent. It may have the potential to achieve £300 in the future, but again, fear and lack of courage to take the risk of buying the stock at £50.

Mutual fund investments have options to regularly invest at intervals. In a fund that rises over the long term, this benefits from pound-cost averaging. This is where purchases are made in the troughs and at the peaks throughout the volatility cycle in the share price. This smooths out the average purchase price over time

Mutual fund managers are experts who deal with millions and billions of assets under management. Unless you’re willing and able to dedicate 2-3 hours a day toward research and stock analysis, it may prove best to let them take the headache of investing your money.

However, if you have enough knowledge, can ride the tumultuous ups and downs and have done adequate due diligence and analysis, you can also invest in quality stocks.

The reality remains, if you want to be really successful, you have to become really good at what you do.

Your best chance of making a ton of money is via your own profession and not by saving and investing.

People who have become multi-millionaires or billionaires by investing are people who made investing their profession and devoted their lives to it.

You can potentially make 30-40 per cent from the stock markets but for that you have to become exceptional at picking stocks – in the top 1 per cent of all stock pickers and better than the best Mutual Fund managers – and for that you need to make it your life’s pursuit, essentially making that your primary occupation.

Or you could stick to what you are already good at and like doing and continuously become better at it.

That’s where the biggest opportunity for getting rich lies for all of us – in our own work.

Work up that company, look for shifting jobs, go do that course or attend that networking event or join a promising start-up early. These will help you level up in your career. Invest in yourself so the markets can preserve your capital, letting it grow with low risk to outpace the prevailing rate of inflation.

Not the be all end all

Being successful isn’t necessarily the hardest thing in the world. It takes equal parts of luck and hard work. But, adding value to something is a lot harder.

Albert Einstein’s quote is a good reminder for those finding themselves blinded by the hunt for success. There’s nothing wrong with success, but it is easy to lose sight of who you are when you’re successful. As Thomas Paine reflected: character is easier kept than recovered. If you keep a watchful eye on your own values, you’ll end up both successful and a good person, which is both a noble and fulfilling pursuit.